In the midst of market uncertainty, three tech stocks are suggested for investment: Alphabet (NASDAQ: GOOGL), Taiwan Semiconductor Manufacturing Company (NYSE: TSM), and Nvidia (NASDAQ: NVDA). These companies are positioned to benefit from ongoing developments in artificial intelligence and semiconductor demand.

Alphabet

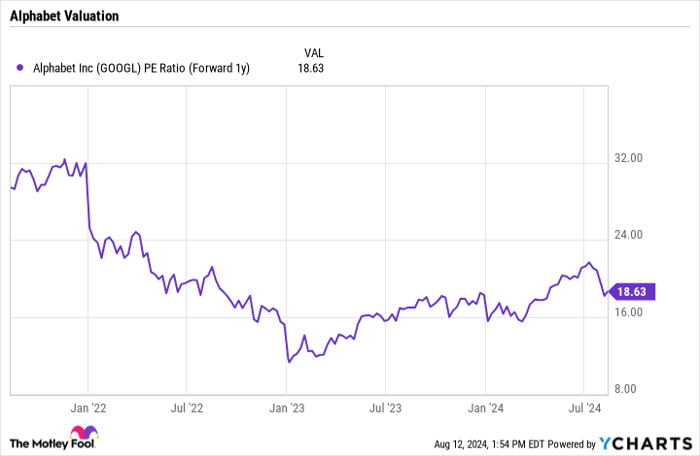

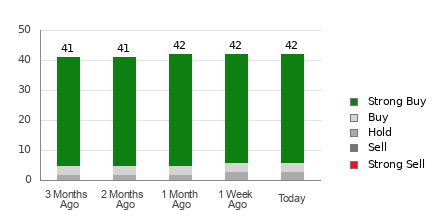

Alphabet’s shares have recently declined due to antitrust concerns and competition in search. Despite a court ruling against the company, the ultimate impact may unfold over several years. Alphabet’s innovation in AI-driven features for search, coupled with its established market presence and strong cash flow, positions it well against competitors. Currently trading at a forward P/E ratio of less than 19, analysts view it as undervalued.

Taiwan Semiconductor Manufacturing

TSMC’s shares fell due to tighter export restrictions to China and political comments regarding Taiwan. Nonetheless, the company reported a 33% year-over-year revenue increase in Q2, reaching $20.8 billion. TSMC is expected to raise prices for certain products, enhancing its growth outlook. Currently, the stock trades at a forward P/E of 20 based on 2025 forecasts, making it an attractive opportunity.

Nvidia

Nvidia’s stock has retreated amid concerns about its Blackwell chip launch, but demand for its existing GPUs remains strong. The rise of AI applications, such as Meta’s Llama 4 model requiring significantly more processing power, supports future demand. Trading under 30 times next year’s earnings consensus, Nvidia is seen as a timely buy.