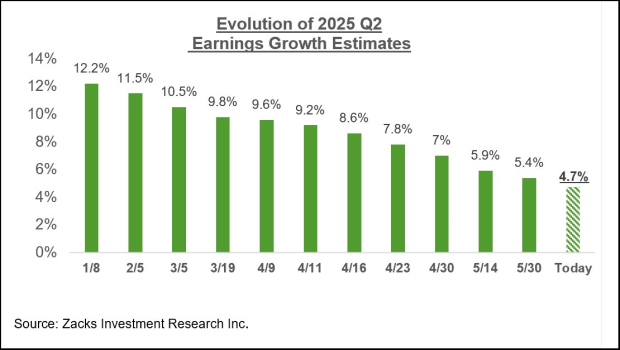

The Q2 earnings season kicks off this week with nearly 100 companies expected to report, including 38 S&P 500 members. Major firms set to release results include Netflix, 3M, Schlumberger, and several big banks. For Q2 2025, earnings growth is anticipated at +4.7% from last year, with revenues up +4%, marking a significant decline compared to recent quarters.

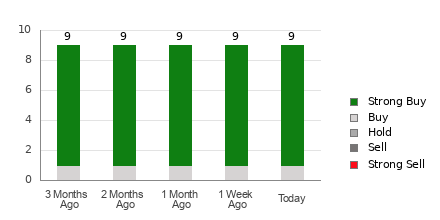

Since early April, earnings estimates have been revised downward for 14 out of 16 Zacks sectors, notably affecting Autos, Energy, Transportation, Basic Materials, and Construction. Despite the negative sentiment affecting the Energy sector—projected to see a -13.3% earnings decline—S&P 500 earnings (excluding Energy) are forecasted to rise by +8.3% in 2025. As of July 11, 2025, 21 S&P 500 companies reported earnings growth of +1.3% year-over-year, with 76.2% beating EPS estimates.

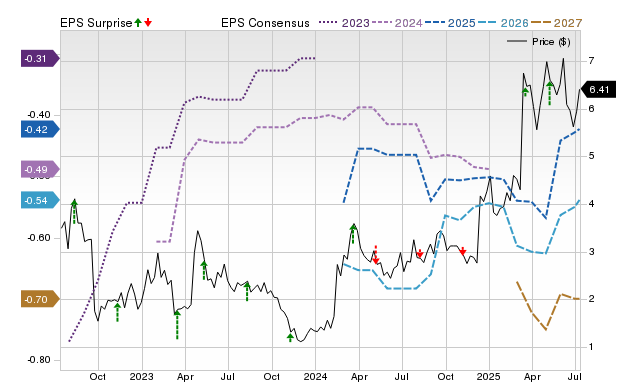

The current EPS for the S&P 500 is projected at $254.07 for 2025 and $287.36 for 2026. Analysts anticipate a favorable earnings season due to lowered expectations, despite macroeconomic uncertainties, with management teams expected to provide positive commentary.