Key Points

-

Nvidia, Advanced Micro Devices (AMD), and Tesla have averaged more than 30% returns in the second half of the year over the past decade.

The S&P 500 is currently trading near record levels, alongside many individual stocks. Despite high valuations, strong company performances suggest continued market bullishness.

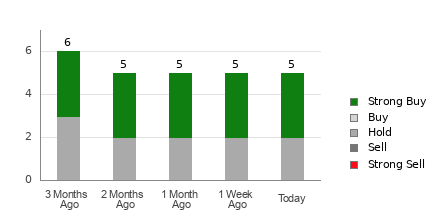

Nvidia

Nvidia recently achieved a $4 trillion market valuation and has increased by 23% this year. Historically, it has had positive second-half returns in 8 of the last 10 years, averaging 33%. Potential challenges include a nearly 50% reduction in market share in China due to export restrictions. Current trade valuation stands at 38 times its estimated future earnings.

Advanced Micro Devices (AMD)

AMD has produced positive second-half returns 7 of the last 10 years, with an average return of 31%. It is up 21% this year, but future success will depend on the demand for its new MI400 chips and its existing product lineup, which reported a 36% sale increase to $7.4 billion last quarter. The stock currently trades at a forward P/E of 39.

Tesla

Tesla has seen mixed results in the second half historically, with an average gain of 40%. After a drop of over 20% this year, its future performance may hinge on CEO Elon Musk’s political involvement and signs of improvement in vehicle deliveries, which fell 14% year-over-year last quarter. The company faces a high valuation with a forward P/E more than 160.