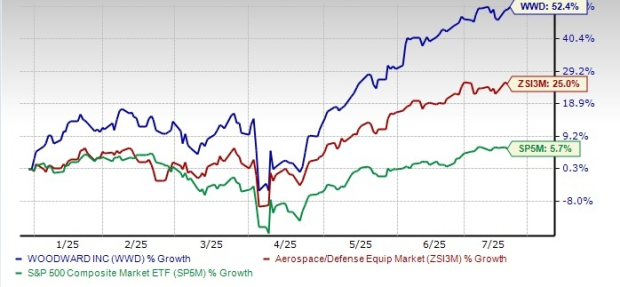

Woodward, Inc. (WWD) has seen a remarkable 52.4% increase in its stock price year-to-date (YTD), significantly outperforming the Aerospace-Defense Equipment industry and the S&P 500, which grew by 25% and 5.7% respectively. The stock closed at $253.64 on October 9, 2025, approaching its 52-week high of $255.69 reached on July 8, 2025.

For fiscal 2025, the company expects its Aerospace segment revenues to rise between 8-13%, up from an earlier prediction of 6-13%. In the second quarter, net sales for the Aerospace segment increased by 12.9% year-over-year due to strong defense demand and a robust commercial aftermarket. The defense OEM sales surged by 52% while commercial aftermarket sales grew by 23%.

Woodward’s Industrial segment is projected to see a revenue decline narrowed to 7-9% for fiscal 2025, improved from the earlier 7-11% forecast. The company aims to return approximately $215 million to stockholders this year, with $130 million remaining under its stock repurchase authorization. Currently, WWD trades at a discounted forward PE ratio of 35.7X versus the industry average of 48.83X.