“`html

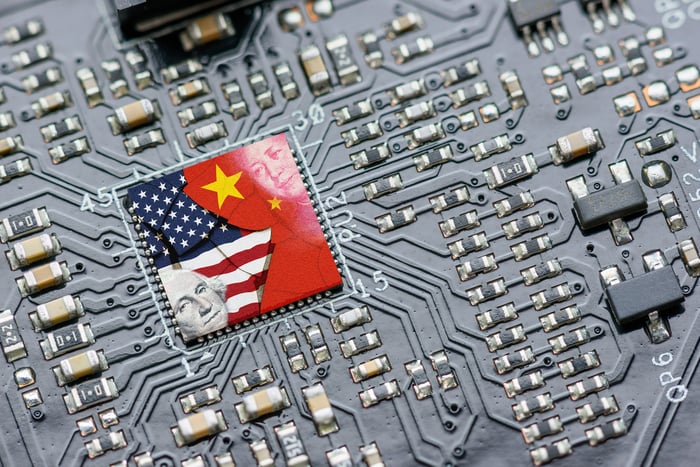

Nvidia Faces Challenges from U.S.-China Trade Tensions

Nvidia (NASDAQ: NVDA) reported a $4.5 billion write-off in Q1 2023 due to U.S. export restrictions on AI chips to China, which have negatively impacted the company’s sales. The restrictions, effective from April 9, resulted in $5.5 billion in revenue loss, as China represented a significant portion of the company’s total revenue of $44.1 billion in that quarter. The additional prohibited shipments accounted for $2.5 billion in potential sales.

Performance Amid Adversity

Despite losing sales in China, Nvidia saw a 69% increase in revenue year-over-year, reaching $44.1 billion in Q1 2023. The company aims for $45 billion in revenue in Q2 2023. Nvidia’s stock increased nearly 30% in 2023, hitting a 52-week high of $172.40. As it prepares to resume chip sales to China, Nvidia remains a key player in the AI market, which is projected to grow from $244 billion in 2025 to $1 trillion by 2031.

“`