“`html

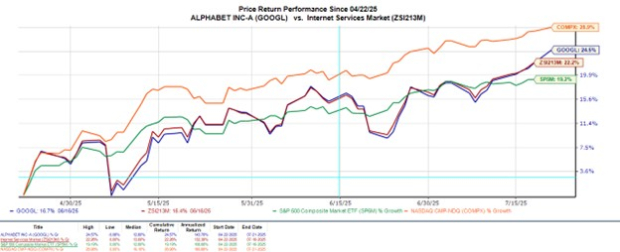

Alphabet Inc. (GOOGL) has rebounded significantly, climbing over 20% in the last three months, and is now flat for 2025 ahead of its Q2 earnings report scheduled for July 23. The company is expecting Q2 sales of $79.25 billion, an 11% increase from $71.36 billion year-over-year, with EPS projected at $2.14, marking a 13% rise from $1.89 a year ago.

Concerns persist regarding Alphabet’s Google Cloud services, which have been losing market share to competitors like Microsoft Azure and Amazon AWS. Additionally, the company has announced job cuts in its cloud division, prompting investor anxiety over potential growth challenges.

Alphabet is planning $75 billion in capital spending on AI infrastructure this year, up from $52.4 billion in 2024. The firm had over $95 billion in cash and equivalents at the end of Q1 and $475.37 billion in total assets, exceeding its liabilities of $130.1 billion, indicating a robust balance sheet.

“`