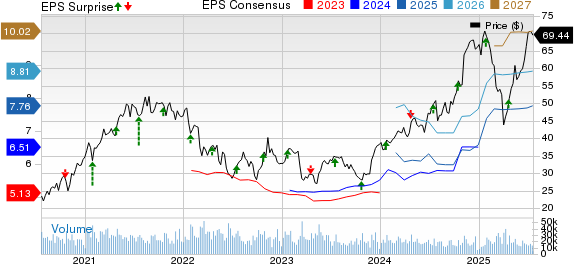

Synchrony Financial (SYF) reported a Q2 2025 adjusted earnings per share (EPS) of $2.50, exceeding the Zacks Consensus Estimate by 45.4% and rising 61.3% year over year. The company recorded net interest income of $4.5 billion, a 2.6% year-over-year increase that also surpassed expectations by 0.5%.

Total loan receivables declined 2.5% year-over-year to $99.8 billion, missing consensus estimates of $100.9 billion. The total purchase volume also fell 2% year-over-year to $46.1 billion but beat previous estimates of $45.4 billion. Additionally, total deposits decreased by 1% to $82.3 billion, below estimates of $83.9 billion.

Management revised its 2025 guidance, projecting net revenues between $15 billion and $15.3 billion, down from earlier estimates of $15.2-$15.7 billion. The efficiency ratio is now expected to range from 32% to 33%, compared to prior guidance of 31.5-32.5%.