“`html

Key Economic Updates from Today’s Event

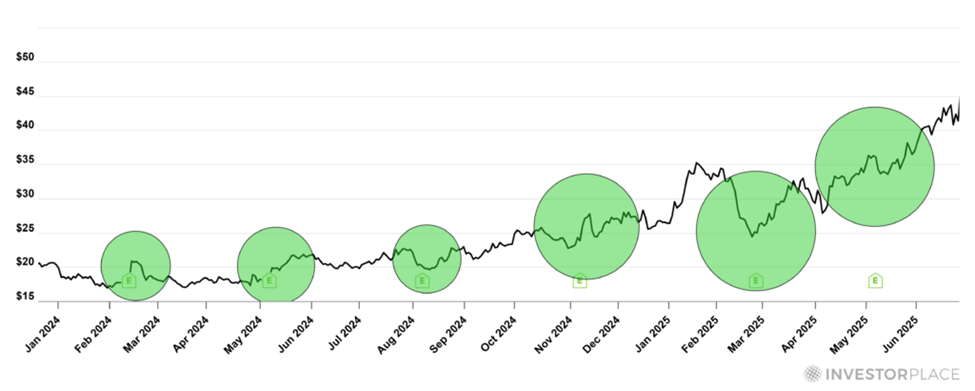

This morning’s live event featured TradeSmith CEO Keith Kaplan and analyst Louis Navellier, who discussed a new trading tool that analyzes historical stock patterns to determine optimal buy and sell dates. The tool signals a bearish market trend beginning next week, even as select stocks may offer significant gains despite overall market weakness.

Key economic indicators show a concerning trend; the Conference Board’s Leading Economic Index (LEI) fell 0.3% in June and has decreased 2.8% over the first half of 2025. This follows a downward trend and warns of potential economic weakening. Additionally, 12% of S&P 500 companies that have reported Q2 earnings thus far showed 83% exceeding earnings per share estimates, which is above the historical averages.

Market valuations are high, with the S&P 500’s forward 12-month P/E ratio at 22.2, 12% above the 5-year average. In contrast, certain AI tech leaders maintain “normal” valuations, suggesting potential for growth as businesses increasingly adopt AI technologies.

“`