UiPath (PATH) remains a leading player in the robotic process automation (RPA) market, reporting a revenue increase of 6% year-over-year, totaling $357 million for Q1 FY2026, and an annual recurring revenue of $1.69 billion. The company maintains a net retention rate of 110-115% and has strategic partnerships with Microsoft, Amazon, and Salesforce.

AppLovin (APP) has recently launched its advanced AI engine, Axon 2, leading to a surge in ad performance and an estimated annual run rate of $10 billion in ad spend from gaming clients. Despite this growth, UiPath’s forward sales multiple of 4.09X is significantly lower than AppLovin’s 19.88X, indicating UiPath may be the more attractive investment option.

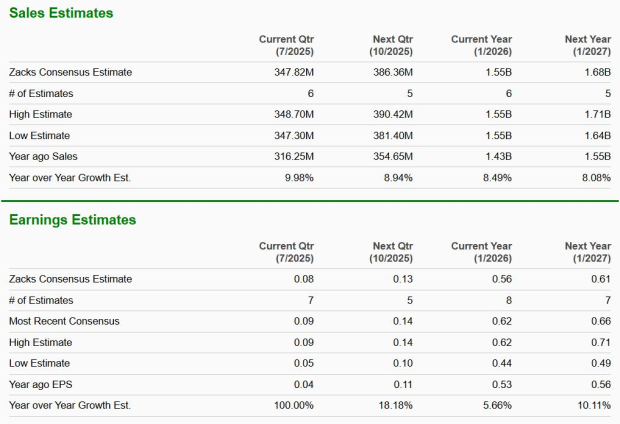

In terms of growth estimates, UiPath’s sales and EPS projections for 2025 reflect a year-over-year increase of 8.5% and 5.7%, while AppLovin’s estimates indicate growth of 16.3% and 85.4%, respectively. However, UiPath’s Zacks Rank is #1 (Strong Buy), compared to AppLovin’s #3 (Hold).