CoreWeave (CRWV) is expanding its AI infrastructure with a $6 billion investment to build a new data center in Lancaster, PA, aiming for an initial capacity of 100 megawatts (MW) and potential scalability to 300 MW. The company has 33 data centers across the U.S. and Europe, supported by 420 megawatts of active power. In contrast, Amazon Web Services (AMZN) leads the cloud market and recently reported a 17% year-over-year revenue increase in Q1 2025, with a revenue run rate of $117 billion and a backlog of $189 billion.

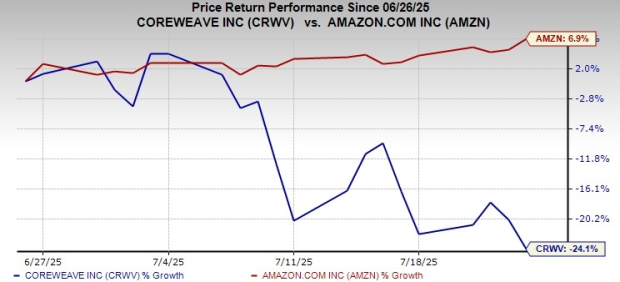

Investors are weighing the performance of both companies. CoreWeave has a significant $259 billion revenue backlog and is strategically aligning with major players like OpenAI and NVIDIA. However, CORE’s stock faced a 24.1% decrease following a $9 billion acquisition announcement. Meanwhile, Amazon’s AI segment operates at a multi-billion-dollar revenue run rate, boosted by custom silicon development and expanding model offerings.

As of March 31, 2025, Amazon holds $66.2 billion in cash, while CRWV’s heavy capital expenditures are a concern due to reliance on debt financing. Current valuations show CRWV at a price/book ratio of 30.22, compared to Amazon’s 8.06. Analyst ratings place Amazon as a Zacks Rank #1 (Strong Buy) while CRWV holds a Zacks Rank #4 (Sell), making Amazon the more favorable choice for long-term growth in AI infrastructure.