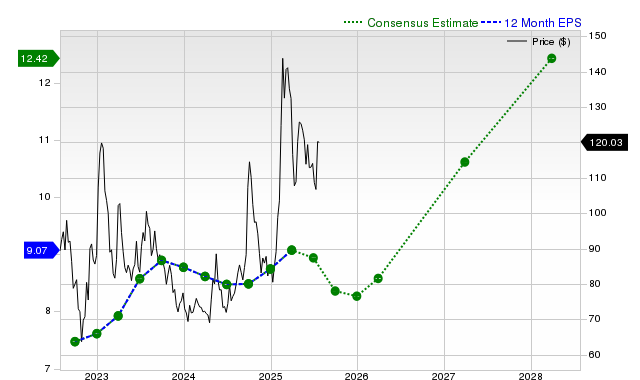

PepsiCo (NASDAQ: PEP) is currently facing challenges as its stock has fallen 25% from its 2023 highs, entering a personal bear market. This decline has resulted in a historically high dividend yield of 3.7%. The company, which operates in beverages and snacks, has increased its dividend annually for 53 consecutive years, showcasing its resilience even amid geopolitical turmoil affecting markets.

The downturn in PepsiCo’s stock is attributed to slowed growth in the snack category and overall top-line growth after a post-pandemic spike. Despite these challenges, PepsiCo is proactively investing in its growth strategy by acquiring brands that resonate with current consumer trends, such as Siete Foods and Poppi. These acquisitions are expected to enhance product offerings and spur growth once integrated into PepsiCo’s extensive distribution network.

Ultimately, while PepsiCo’s business turnaround may take time, its historical success and strategic moves suggest a positive outlook for future growth and sustainable dividends.