Alibaba Group Holding Limited (BABA) has seen its shares return -0.9% over the past month, contrasting with the Zacks S&P 500 composite’s +4.1% change and the Zacks Internet – Commerce industry’s +4.8% gain during the same period. The company is projected to post earnings of $2.24 per share for the current quarter, reflecting a -6.7% year-over-year change, with the latest consensus estimates showing a +17% revision over the past 30 days.

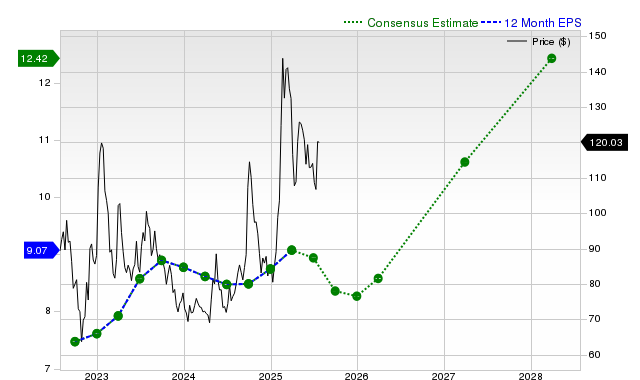

For the current fiscal year, the consensus earnings estimate stands at $8.20, which indicates a -4.9% change from the previous year, having dropped -1.7% in the last month. In contrast, estimates for the next fiscal year are projected at $9.20, indicating a growth of +12.2%.

Additionally, the company’s revenue expectations for the current quarter are set at $34.95 billion, which denotes an +8.2% increase year-over-year. Last reported quarterly revenues hit $30.73 billion, a year-over-year growth of +1.4%, surpassing the Zacks Consensus Estimate by +0.46%. Despite a rating of Rank #3 (Hold) by Zacks, suggesting alignment with market performance, some analysts indicate that Alibaba may be undervalued relative to its peers.