C3.ai (NYSE: AI) reported a 20% year-over-year revenue growth for Q4 fiscal 2024, generating $86.6 million, surpassing the $84.4 million consensus estimate. The company’s non-GAAP net loss improved to $0.11 per share, better than the projected loss of $0.30 per share. CEO Thomas Siebel cited increasing demand for enterprise AI software as a key driver of this growth.

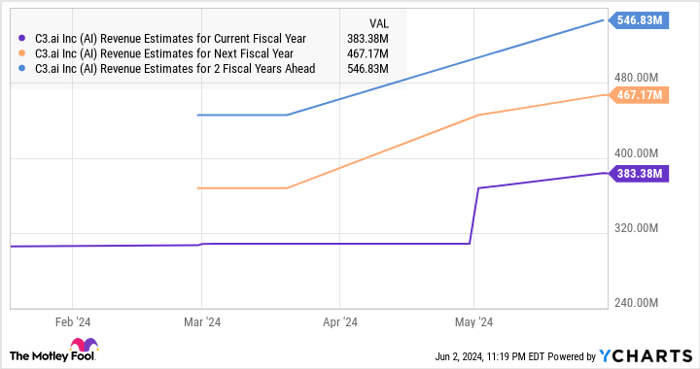

For fiscal 2025, C3.ai anticipates revenue between $370 million and $395 million, indicating a potential 23% increase from the previous year. The company signed 191 client agreements in the last fiscal year, a rise of 52% from 2023, and has 34 active pilot projects. Federal revenue more than doubled, suggesting a solid growth trajectory in that segment as governments invest in AI technology.

Currently trading at 11 times sales, C3.ai remains more affordable than competitors like Palantir Technologies, priced at 22 times sales. Analysts are optimistic about C3.ai’s growth potential, given the software market’s expected annual growth rate of 69% through 2032, reaching $280 billion in revenue.