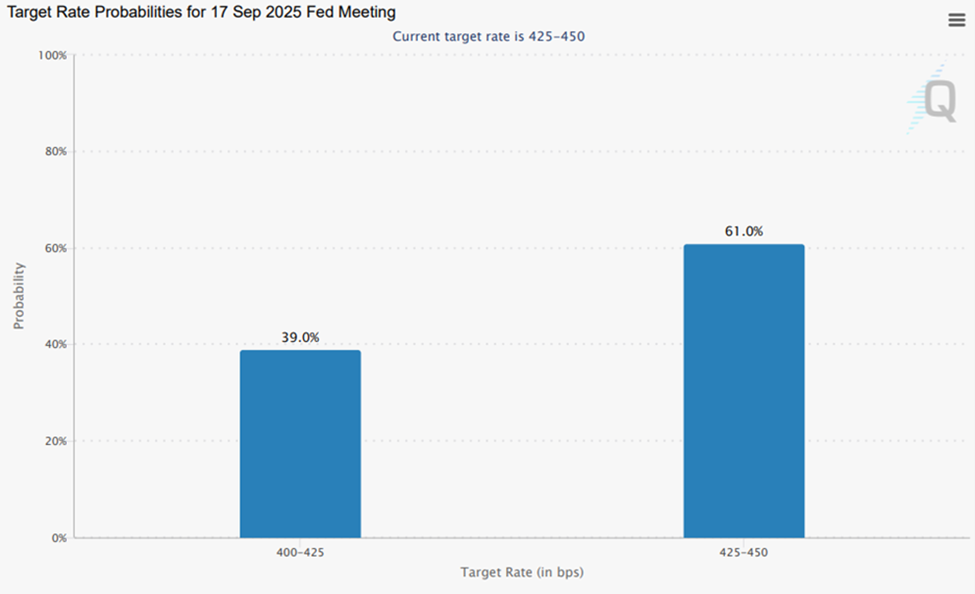

Summary: The Federal Reserve has held interest rates steady for the eighth consecutive meeting, maintaining the fed funds rate between 4.25% and 4.50% since December 2024. This decision comes amid signs of easing inflation and slowing economic growth, leading some Fed members to dissent for the first time in three decades.

The recently released Personal Consumption Expenditures (PCE) index shows core inflation rose 0.3% in June, outpacing expectations of 0.2%, but on a year-over-year basis remains at 2.8%. Meanwhile, real personal spending and personal income both increased by 0.3%, but still fell short of economists’ forecasts.

There’s a growing risk that the Fed’s cautious approach could hinder growth, according to analysts like Louis Navellier, who argue that the Fed needs to cut rates in September and continue reductions to about 3% to avoid negative economic consequences.