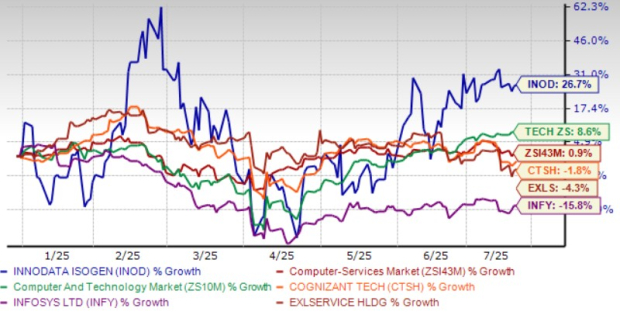

Innodata (INOD) shares closed at $50.10 on Thursday, 29.4% below the 52-week high of $71 from February 21, 2025. Year-to-date, shares have appreciated by 26.8%, outperforming the Zacks Computer and Technology sector’s 8.6% return and the Zacks Computer–Services industry’s 0.9% return. Innodata is confidently investing in AI technology, with plans to spend $2 million in the second quarter of 2025 to support its largest customer.

Innodata competes favorably against major companies like Cognizant (CTSH), Infosys (INFY), and ExlService (EXLS), whose shares have decreased by 1.8%, 15.8%, and 4.3%, respectively, year-to-date. The company plans to harness the growing Generative AI market, projected to reach $200 billion by 2029, while targeting a 40% adjusted gross margin, down from the previous year’s 41%.

The consensus estimate for second-quarter 2025 earnings stands at 11 cents per share, with a projected revenue increase of 40% year-over-year to $238.6 million. Despite facing short-term margin pressures, Innodata is well-positioned to capitalize on expanding contracts, including a new $8 million engagement from multiple Big Tech clients.