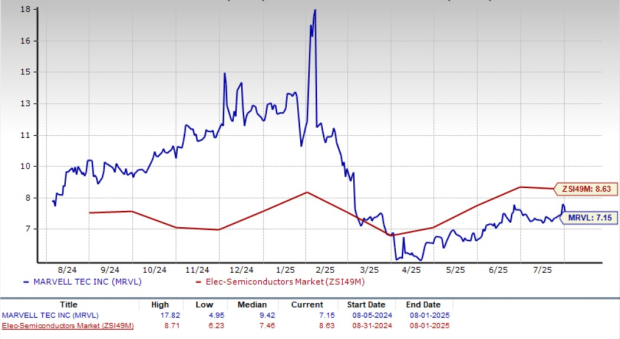

Marvell Technology (MRVL) is currently trading at a 12-month forward price-to-earnings (P/E) ratio of 7.15X, below the industry average of 8.63X. The consensus estimate for the company’s revenues in fiscal 2026 is $8.2 billion, reflecting a year-over-year growth of 42.6%, with earnings projected at $2.79 per share, indicating a 77.7% increase.

Despite high revenue growth in its data center segment, which saw 76% year-over-year growth in Q1 fiscal 2026, Marvell faces challenges including geopolitical tensions affecting 43% of its revenue stemming from China, declining margins in AI-focused custom silicon products, and fierce competition from companies like Broadcom, Advanced Micro Devices, and Micron Technology. Year-to-date, MRVL’s stock has underperformed, decreasing by 32.6% compared to its industry.

Given these factors, analysts suggest holding MRVL stock, currently rated as a Zacks Rank #3 (Hold), while recognizing the company’s strong fundamentals in the data center and high-speed networking sectors.