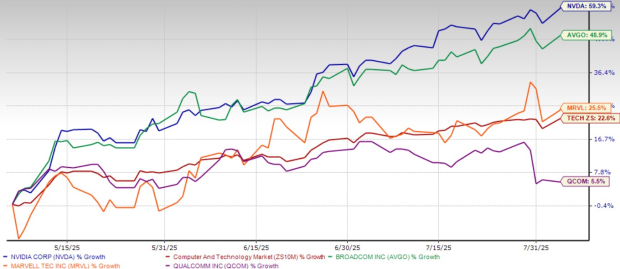

NVIDIA Corporation (NVDA) has seen its share price increase by 59.3% over the past three months, significantly outperforming the Zacks Computer and Technology sector’s 22.7% gain. The stock closed at $180.00 on August 4, just shy of its 52-week high of $183.30 reached on July 31.

In the first quarter of fiscal 2026, NVIDIA’s Data Center segment generated $39.1 billion in revenue, accounting for 89% of total sales, marking a 73% year-over-year growth. Despite projecting an $8 billion revenue loss in the second quarter due to export restrictions on certain products to China, NVIDIA expects second-quarter revenues to reach $45 billion, up 50% year-over-year. Current estimates for fiscal 2026 predict a 52% revenue growth and earnings growth of 42.5%.

NVIDIA’s shares are currently trading at a forward Price/Earnings ratio of 36.3, above the sector average of 27.68. While its financial momentum remains strong, concerns regarding its valuation persist.