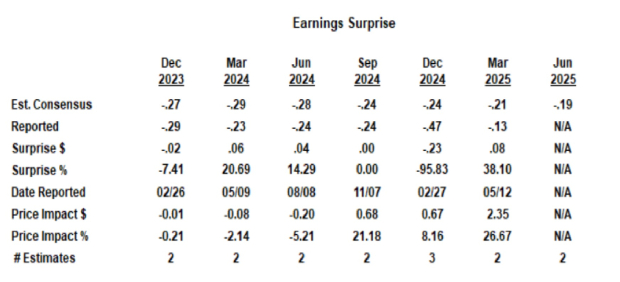

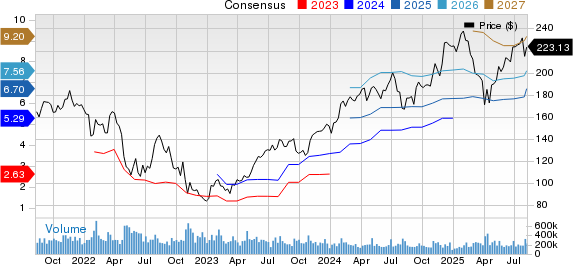

Archer Aviation Inc. (ACHR) shares have increased by 169.2% over the past year, outpacing the Aerospace – Defense industry, which saw a 16.1% rise. The company, preparing for an earnings report on August 11, is projected to announce a loss of 19 cents per share amidst minimal revenue generation.

The global electric vertical takeoff and landing (eVTOL) market is expected to grow at a compound annual growth rate (CAGR) of 54.9% from 2024 to 2030, a trend Archer Aviation aims to capitalize on. Key partnerships include collaborations with United Airlines for an air taxi network and Stellantis to expand manufacturing, alongside efforts with Anduril for military applications and Palantir for AI software in aviation.

The company is launching its first air taxi service in Abu Dhabi, which could set the stage for similar services in the U.S. Investors remain cautious ahead of earnings, as positive news on production and FAA approvals may influence stock performance.