Advanced Micro Devices (AMD) reported second-quarter 2025 results on August 5, leading to a 1.1% decline in share prices. The results were impacted by U.S. export controls on MI308 sales to China, resulting in an $800 million inventory write-down. The second-quarter gross margin fell to 43% from 53% a year ago, while operating margin decreased to 12% from 22% due to inventory charges.

Despite the challenges, AMD projects third-quarter revenues to be approximately $8.7 billion (+/- $300 million), indicating a year-over-year growth of 28% at the midpoint. Gross margins are expected to reach around 54%, with a Zacks Consensus Estimate for earnings at $1.16 per share, reflecting a 26.1% increase from the previous year.

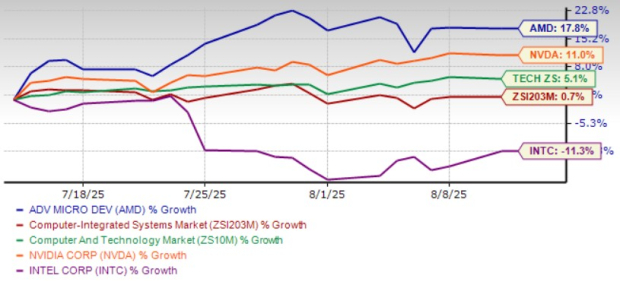

AMD is expanding its AI capabilities with the new MI350 GPUs and EPYC portfolio, leveraging demand from cloud providers like Google and Oracle. However, it faces stiff competition from NVIDIA, which saw a 73.3% year-over-year growth in data center revenues recently. AMD’s stock remains classified as overvalued, trading at a forward 12-month Price/Sales of 7.71X compared to the industry average of 3.72X.