The Nasdaq and the S&P 500 reached new highs on Tuesday as Wall Street anticipates interest rate cuts following a cooler-than-expected inflation report for July. In addition, earnings for S&P 500 companies that reported are up 11.6% year-over-year with a 5.9% increase in revenue, setting the stage for a potential all-time quarterly record in aggregate earnings, according to Zacks data.

SSR Mining Inc. (SSRM), a Denver-based gold and silver mining company, reported significant Q2 results on August 5, with gold-equivalent production increasing from 76K ounces to 120K ounces and a revenue surge of 119%. Adjusted earnings rose from $0.04 to $0.51 per share, exceeding estimates by 122%. SSRM’s earnings outlook shows a 400% projected growth in adjusted earnings for FY25, supported by a 52% sales increase.

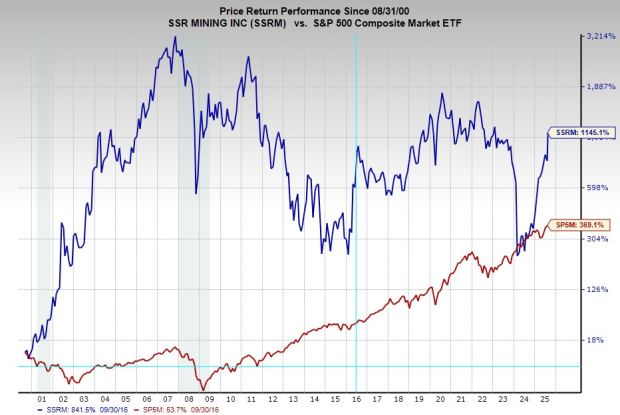

Currently, SSRM’s stock has increased 220% over the past year but remains 60% below its 2007 peak. It is trading at a 50% discount compared to its sector with a price-to-earnings-to-growth (PEG) ratio of 0.4, which is significantly lower than both the S&P 500 and its five-year highs.