Innodata Inc. (INOD) reported a 97.7% year-over-year revenue growth for the first six months of 2025, totaling $116.7 million. This surge is attributed to increased demand from existing clients and higher subscription volumes on its Agility AI-enabled platform. The company is pivoting towards offering Agentic AI services, focusing on smart data for improved performance in large language models (LLMs).

Innodata is positioned to compete against major players like Microsoft Corporation (MSFT) and Unisys Corporation (UIS) in the Agentic AI market. Microsoft’s Azure AI services and Unisys’s recent cloud AI solutions pose substantial competition as Innodata continues its investments in growth initiatives aimed at enhancing custom annotation pipelines and agent development.

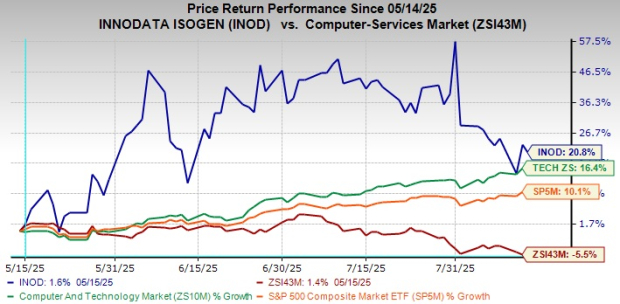

Currently, Innodata’s stock has risen 20.8% over the past three months, reflecting a forward price-to-sales ratio of 4.91, indicating strong market potential despite anticipated earnings declines in 2025. Estimated earnings for 2025 are projected at 71 cents per share, while 2026 estimates show an increase to $1.05 per share, signaling potential profitability growth.