“`html

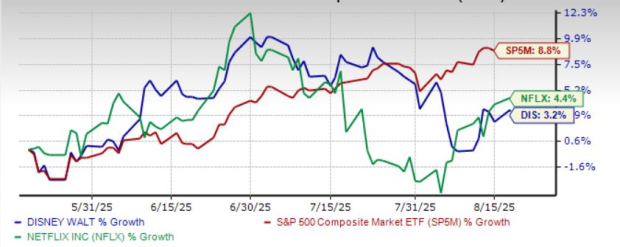

General Mills (GIS) shares have fallen 26% over the past year, significantly underperforming compared to the S&P 500’s 17% gain. The company reported a 3% decline in organic net sales year-over-year, driven by lower volumes and an unfavorable price mix, while its gross margin dropped 340 basis points to 32.4%. Operating profit fell 35% year-over-year to $504 million.

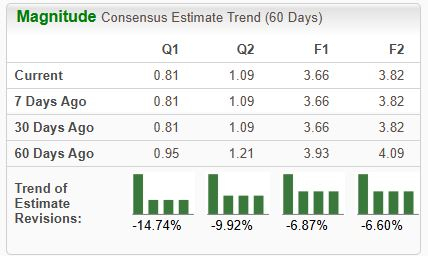

As of now, General Mills holds a Zacks Rank #5 (Strong Sell), reflecting a bearish outlook from analysts regarding its earnings. The company’s next earnings release is scheduled for mid-September, with sales revisions maintaining a similar negative trend.

“`