“`html

Spotify Technology S.A. (SPOT) reported a significant increase in free cash flow (FCF) of €2.8 billion for the second quarter of 2025, marking an 8% rise from the previous quarter and a 115% increase year-over-year. In June 2025, Spotify generated €700 million in FCF, an increase of 31.1% sequentially and 42.9% from the same quarter last year.

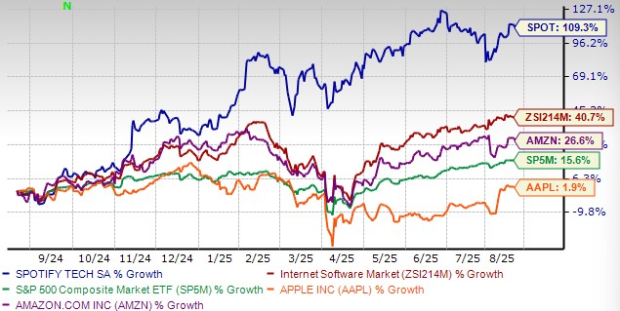

The company’s total revenue for the quarter reached €4.2 billion, up 10% year-over-year, driven by 12% growth in key metrics. Gross margins improved to 31.5%, reflecting 227 basis points growth compared to the previous year. Spotify’s stock has surged 109.3% over the last year, outperforming the industry average of 40.7% and the S&P 500’s 15.6% growth.

Spotify currently trades at a forward price-to-earnings ratio of 74.49X, higher than the industry average of 39.35X, with a Zacks Rank of #4 (Sell). The Zacks Consensus Estimate for Spotify’s earnings for 2025 and 2026 has seen declines of 38.1% and 10%, respectively, over the past 60 days.

“`