“`html

Trend Investing Insights: Are All-Time Highs Safe?

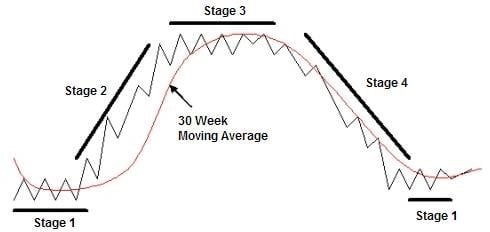

Richard Dennis, a famed trader, turned $400 into over $200 million in the 1970s and 1980s, emphasizing the importance of following major market trends. His findings suggest that investing at all-time highs can yield significant returns, as momentum remains strong despite concerns over high stock valuations.

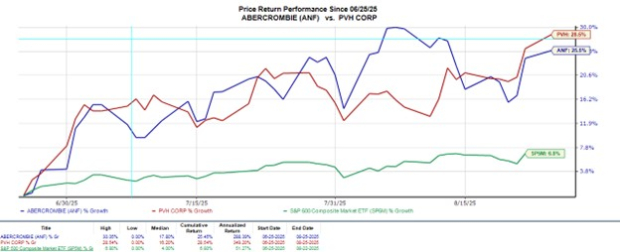

Recent statements from analysts indicate that despite indicators suggesting market overvaluation, late-stage bull markets can produce substantial profits. Meb Faber, CEO of Cambria Investments, highlights that a strategy involving remaining invested in stocks at all-time highs can lead to better returns and lower volatility.

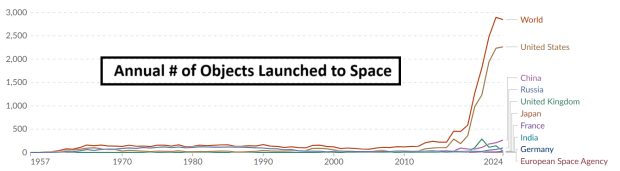

For instance, Luke Lango notes the potential for AI and tech stocks to generate substantial gains, referencing stocks like AppLovin Corp. (+500% in five months) and SoundHound AI Inc. (+300% in three months). As interest rates appear set for cuts, this bullish trend may have room to grow before it’s potentially met with macroeconomic headwinds.

“`