Berkshire Hathaway Sells Apple Shares Amidst Valuation Concerns

Berkshire Hathaway (NYSE: BRK.A, BRK.B) has sold 635 million shares of Apple (NASDAQ: AAPL) since Q4 2023, divesting 20 million shares in Q2 2024 alone. This reduction leaves Berkshire with an Apple stake valued at $64 billion, making up 21.4% of its portfolio. The company’s investment in Apple, initiated in 2016, has yielded a 766% increase, but escalating valuations, with a price-to-earnings (P/E) ratio of 34.6, have diminished its appeal, prompting concerns over sustainability.

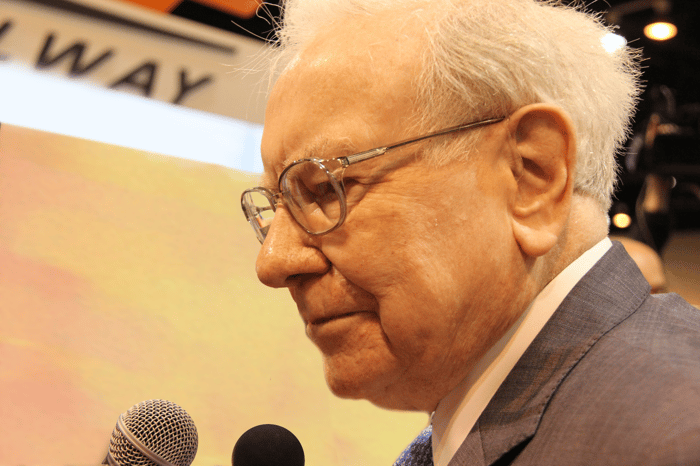

Warren Buffett is reportedly preparing for potential tax increases in the U.S. amid rising federal debt of $36 trillion. His move to sell off shares may be strategically timed to avoid capital gains taxes that could arise from potential policy changes. Additionally, Berkshire’s liquid cash position has grown to $344 billion underlines Buffett’s cautious approach as he plans to hand over leadership to successor Greg Abel by year-end 2023.