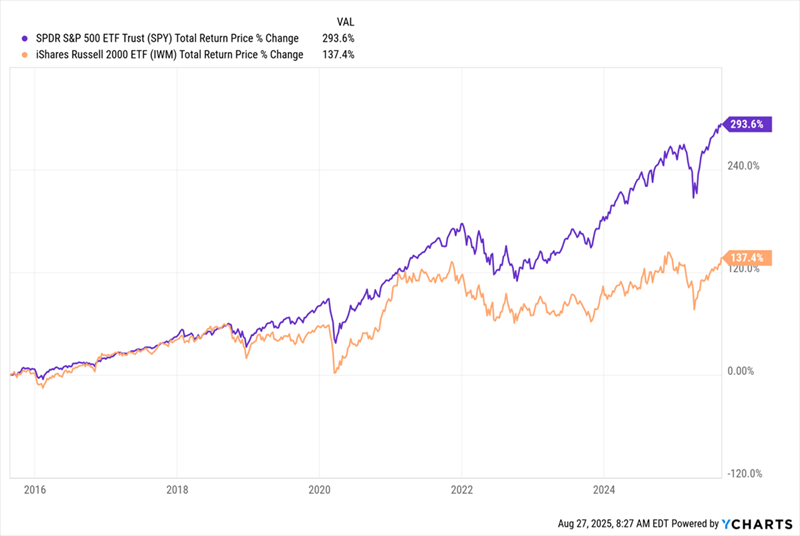

Large cap stocks have significantly outperformed small cap stocks in recent years, leading to a notable disparity in dividend yields, with the iShares Russell 2000 ETF (IWM) yielding just 1.1%. In contrast, the Royce Small-Cap Trust (RVT) offers a much higher yield of 7.2% and has shown strong performance, with its net asset value (NAV) return nearing 10% this year, surpassing the small-cap index’s 6.6% return.

Since the pandemic, small cap stocks have lagged behind the S&P 500, which is dominated by large tech firms like Apple, Alphabet, Meta Platforms, and Microsoft. These companies constitute 25% of the S&P 500’s earnings and 40% of its market cap, raising concerns about the sustainability of this trend. As investors may begin to diversify away from these mega-caps, small cap stocks, including funds like RVT, are positioned to attract more capital.

RVT’s growing discount to NAV, recently hitting double digits, presents a potential opportunity for savvy investors. This closed-end fund focuses on smaller companies with promising growth, offering not only income through dividends but also the potential for capital appreciation as the market corrects the current mispricing.