“`html

JD.com reported its second-quarter 2025 results, showcasing a 199% year-over-year revenue increase in its New Businesses segment, primarily driven by food delivery efforts, which now sees over 25 million daily orders and a rider network exceeding 150,000. However, the segment incurred an operating loss of RMB 14.8 billion, leading to a negative operating margin of 106.7%, as aggressive marketing and logistics investments, particularly during the 618 Festival, significantly increased costs.

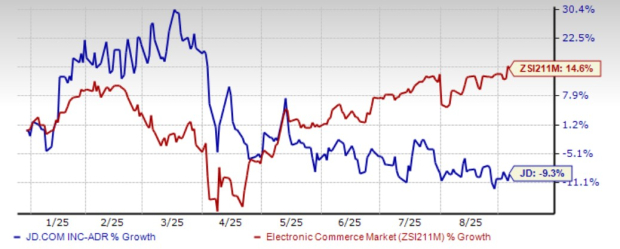

As competition intensifies, JD.com faces accelerating losses, projecting a potential cash burn of RMB 34 billion for 2025, following a RMB 1.3 billion deficit in Q1. Marketing expenses surged by 127.6% year-over-year, adding financial pressure. JD.com’s stock has declined 9.3% year-to-date, substantially trailing the industry’s growth of 14.6%, while its forward price-to-earnings ratio stands at 9.47, below the industry average of 25.2.

“`