“`html

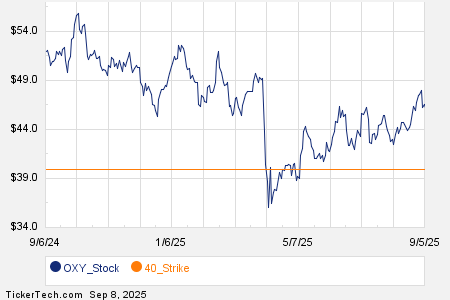

On October 10, 2023, Occidental Petroleum Corp (OXY) experienced significant options trading, with 44,451 contracts exchanged, equating to 4.4 million underlying shares—52% of its average daily volume of 8.5 million shares. High activity was noted for the $40 strike put option, with 15,071 contracts traded, representing about 1.5 million shares.

PayPal Holdings Inc (PYPL) saw a trading volume of 47,396 contracts today, amounting to approximately 4.7 million underlying shares, or 50.6% of its average daily volume of 9.4 million shares. The $67 strike call option for expiration on September 12, 2025, was particularly active, with 3,565 contracts traded, amounting to around 356,500 shares.

Illinois Tool Works, Inc. (ITW) recorded options trading of 4,322 contracts, representing around 432,200 underlying shares—50.3% of its average daily volume of 858,870 shares. The $280 strike call option expiring on December 19, 2025, was especially notable, with 4,003 contracts traded, equivalent to approximately 400,300 shares.

“`