“`html

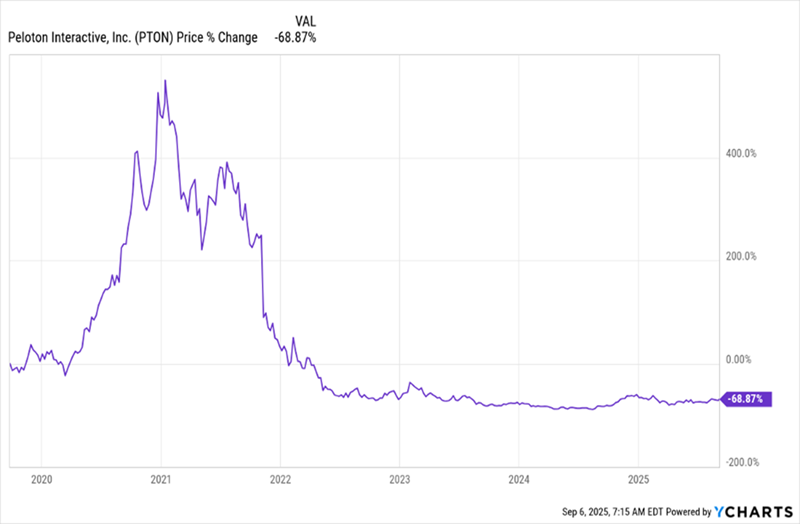

Peloton Interactive (PTON) has faced a significant decline, with its net income remaining negative since the pandemic ended. The stock, initially buoyed by speculation during increased indoor exercising, has dropped considerably as investor hopes taper.

In contrast, the BlackRock Science and Technology Term Trust (BSTZ) achieved a 27.3% price gain as its discount to net asset value (NAV) narrowed from 13% in October 2024 to 7.7% today. Additionally, Generation Z is increasingly interested in dividends, moving away from riskier investments and focusing on steady payouts, as noted in a Bloomberg report from September 4, 2025.

Young investors are leaning towards high-yielding closed-end funds (CEFs), with BSTZ offering a 12% yield compared to the YieldMax TSLA Option Income Strategy ETF (TSLY), which has a yield of 66.6% but only a 17% total return over the last three years. This shift in investor preference may lead to increased demand for CEFs like BSTZ in the future.

“`