“`html

Business Development Companies (BDCs) are increasingly appealing for income-seeking investors, offering dividend yields between 10.6% and 12.6%. BDCs are required by law to distribute at least 90% of their taxable income, positioning them as reliable dividend sources compared to traditional stocks.

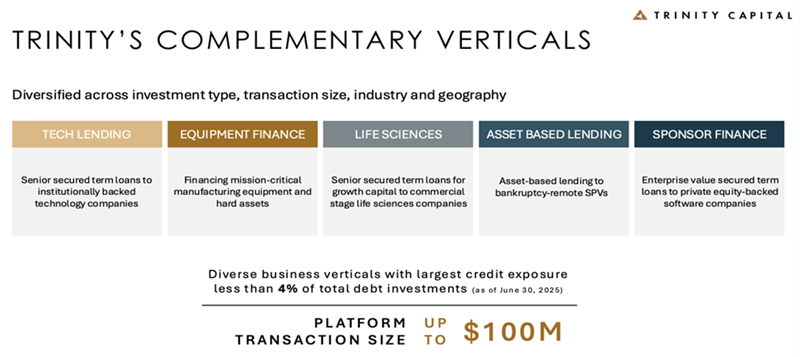

Investment opportunities highlighted include the Morgan Stanley Direct Lending Fund (MSDL) with an 11.1% yield, Trinity Capital (TRIN) yielding 12.6%, and Oaktree Specialty Lending Corp. (OCSL) at 12.0%. MSDL focuses on floating-rate loans, while TRIN has performed well in the growth-stage company sector since going public in January 2021. OCSL, although facing a decrease in its regular dividend by 27% earlier this year, currently offers a 16% discount to net asset value.

Additionally, Blackstone Secured Lending Fund (BXSL) yields 10.6% and primarily engages in first-lien senior secured debt. Despite a strong start post-IPO in October 2021, concerns over dividend coverage have emerged. Similarly, Blue Owl Capital Corp. (OBDC) yields 11.3% and manages a diverse portfolio, though it has faced recent performance challenges with non-accruals climbing and NAV decreasing.

“`