“`html

Adobe Inc. reported its third-quarter fiscal 2025 results, highlighting an annual recurring revenue (ARR) from AI products exceeding $250 million and overall ARR surpassing $5 billion. The company’s Digital Media ARR grew by 11.7% year over year, driven by strong demand for AI-powered products, particularly Firefly and Acrobat AI Assistant.

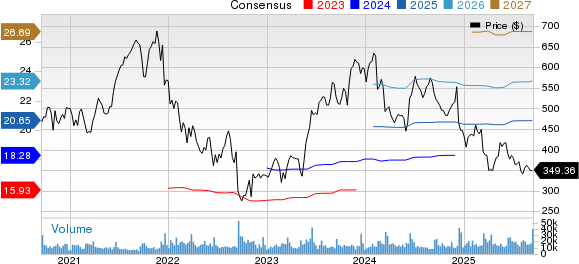

Adobe projects fiscal 2025 revenues of $23.65 billion to $23.7 billion, up from previous estimates, alongside non-GAAP earnings of $20.80 to $20.85 per share. Despite these gains, Adobe’s shares have declined 21.5% year-to-date, lagging behind peers in the tech sector. Competitors such as Microsoft and Alphabet have seen higher revenue growth, highlighting Adobe’s challenges in converting revenues to profits.

Looking ahead, Adobe’s Zacks Rank is #3 (Hold), indicating potential caution for investors amid a stretched valuation and heightened competition in the AI market.

“`