“`html

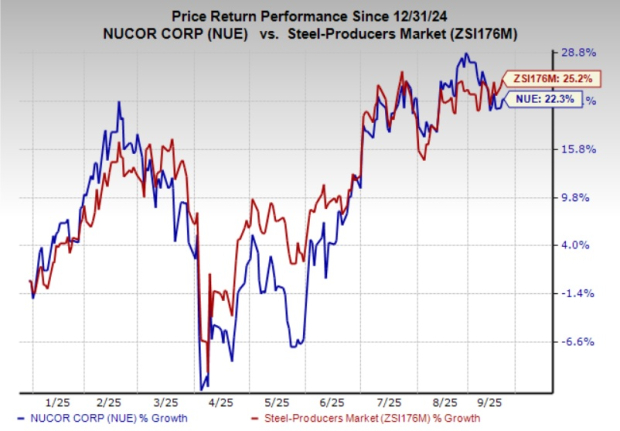

Nucor Corporation (NUE) returned $758 million to shareholders through dividends and share repurchases in the first half of 2025, totaling approximately $985 million year-to-date. During the second quarter, the company returned 55% of its net earnings to shareholders and repurchased around 0.7 million shares in the third quarter, with a total of about 4.8 million shares repurchased this year. Nucor reported strong liquidity of roughly $3.4 billion, including cash and cash equivalents of around $1.95 billion, with operating cash flow of approximately $1.1 billion for the first half of 2025.

Nucor raised its quarterly dividend to 55 cents per share in December 2024, marking 52 consecutive years of dividend increases since it began paying dividends in 1973. The company’s current dividend yield stands at 1.5% with a payout ratio of 36%. Additionally, Steel Dynamics, Inc. (STLD) repurchased $450 million worth of shares in the first half of 2025 and raised its quarterly dividend by 9% to 50 cents per share, while Commercial Metals Company (CMC) repurchased shares worth $203.6 million in the year ending May 31, 2025.

As of 2025, Nucor is trading at a forward 12-month earnings multiple of 14.09, about 28.3% higher than the industry average of 10.98. The Zacks Consensus Estimate for Nucor’s 2025 earnings reflects a year-over-year decline of 8.9%, with EPS estimates trending lower over the past 60 days.

“`