“`html

UiPath, Inc. (PATH) reported significant financial autonomy, ending the second quarter of fiscal 2026 with $1.4 billion in cash and equivalents and zero debt. This positions the company favorably within the competitive automation market, allowing it to focus on growth and innovation, unlike many technology peers who face refinancing pressures.

UiPath’s current ratio stands at 2.75, compared to the industry benchmark of 1.95. This suggests a strong liquidity position, enabling the company to cover obligations and pursue strategic opportunities. In contrast, competitors like Microsoft and ServiceNow face different financial strategies that may limit their focus on automation.

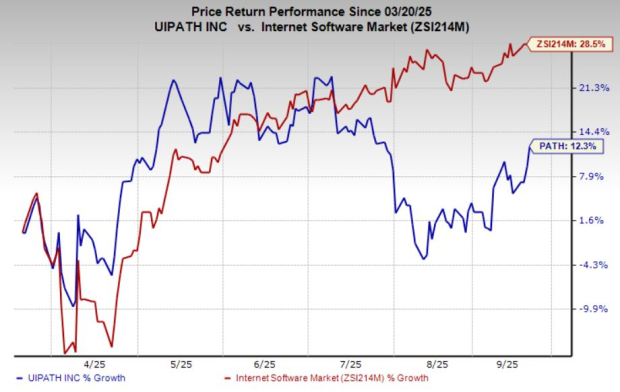

Despite a 12% stock increase over the past six months, UiPath’s valuation remains below the industry average with a forward price-to-earnings ratio of 17.53X against the industry’s 40.16X average, indicating potential for future growth as global demand for automation increases.

“`