“`html

UPS Financial Performance Overview

United Parcel Service (UPS) (NYSE: UPS), one of the world’s largest shipping couriers, has seen its stock price increase from $50 at its IPO on November 10, 1999, to about $85 today. An investment of $10,000 at the IPO would have grown to approximately $17,000, in contrast to an S&P 500 index fund, which would now be worth over $48,000. In 2023, UPS faced challenges such as a decline in average daily package volume from 24.29 million in 2022 to 22.29 million, and a 4% drop in total revenue to $90.96 billion.

Challenges and Future Expectations

UPS’s adjusted operating margin decreased from 13.8% in 2022 to 10.9% in 2023, with diluted earnings per share (EPS) falling from $13.20 in 2022 to $7.80 in 2023. Looking ahead, UPS expects to cut its Amazon-related volumes by at least 50% by mid-2026 and aims for revenue growth of 1% in 2026 and 4% in 2027. Analysts project a 15% rise in EPS for 2026, despite anticipated revenue and EPS declines of 4% and 6%, respectively, for the year, as UPS works to realign its business.

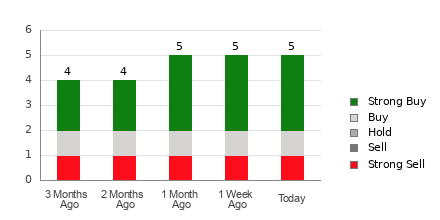

Market Position and Investment Outlook

Analysts caution that UPS may not regain high-growth status until its strategic initiatives yield results. The stock currently trades at 12 times next year’s earnings. If UPS can achieve a compound annual growth rate of 10% in EPS from 2027 to 2035, the stock may reach approximately $347, or a significant recovery, though likely not life-changing for investors.

“`