“`html

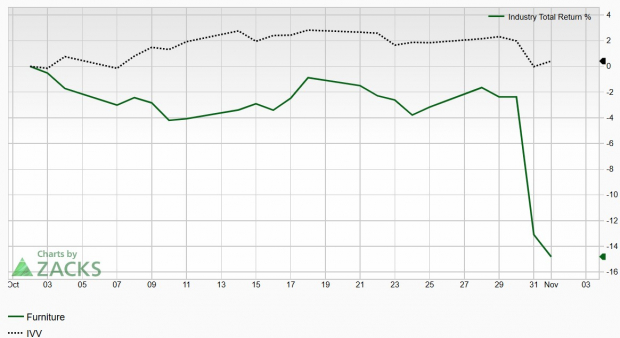

Leggett & Platt has revised its sales forecast for the current fiscal year, expecting a 7%-9% decline in year-over-year revenues due to weaker industry demand, particularly in flooring, textile products, and specialized furniture. This update was made amid increasing competition on [date unspecified].

The company reported third-quarter earnings of $0.32/share, missing the Zacks Consensus Estimate of $0.33/share by -3.03%. Additionally, analysts have cut Q4 earnings estimates by -20.69% in the past 60 days, projecting earnings of $0.23/share, reflecting negative growth of -11.5% year-over-year.

Leggett reduced its quarterly dividend from 44 cents to 5 cents, raising concerns over financial stability. The company’s stock has fallen by more than 50% this year, indicating a sustained downtrend and a “death cross” in its moving averages.

“`