“`html

PCE Inflation Report Summary

The Personal Consumption Expenditures (PCE) Price Index, released on the morning of the latest report, indicates that inflation in the U.S. remains a challenge. The headline PCE increased by 0.3% month-over-month, raising the year-over-year inflation rate to 2.7%. Excluding food and energy, core PCE rose 0.2% in the same period, with a 12-month core rate of 2.9%. These figures align with Dow Jones consensus expectations.

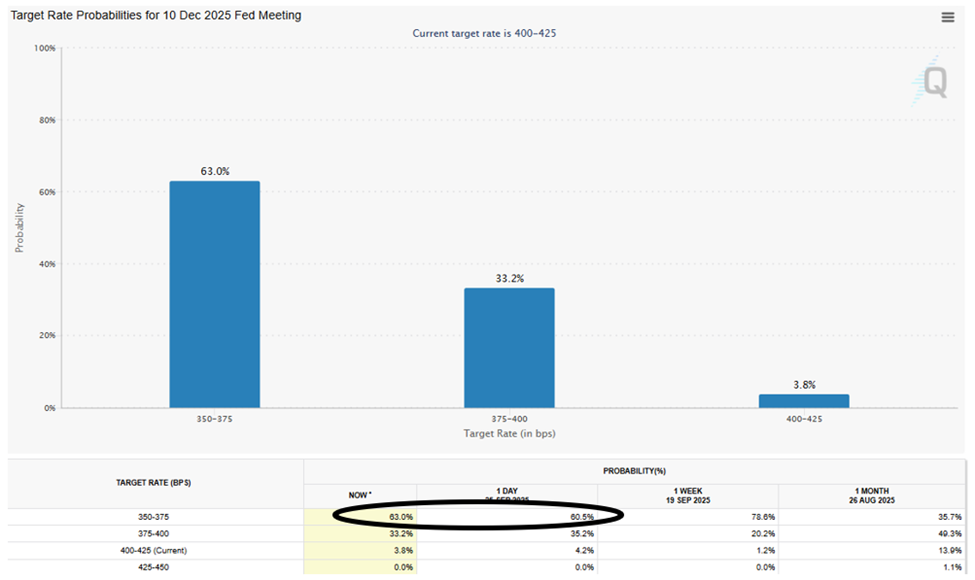

Despite stable headline numbers, the Federal Reserve is cautious as core inflation is significantly above their 2% target, creating pressure for potential rate cuts. The probability of two quarter-point rate cuts has increased from 60.5% to 63% following the report. Additionally, personal consumption expenditures increased by 0.6%, and the personal saving rate rose 0.2 percentage points to 4.6%.

The release of the next jobs report from the Bureau of Labor Statistics is anticipated for next week, which may influence the Fed’s decision regarding interest rates.

“`