“`html

The Personal Consumption Expenditures (PCE) report for August indicates that inflation remains persistent, with a monthly increase of 0.3%, up from 0.2% in July. Year-over-year, headline inflation rose to 2.7%, compared to 2.6% the previous month, aligning with economists’ expectations. Core PCE, excluding food and energy, remained steady at 2.9% annually.

Key factors include a 0.5% rise in food prices and a 0.4% increase in consumer spending, primarily on goods. Despite increased tariffs and borrowing costs, the resilience in household spending suggests potential for another rate cut by the Federal Reserve, with an 85% probability of a 25-basis-point cut at the October meeting.

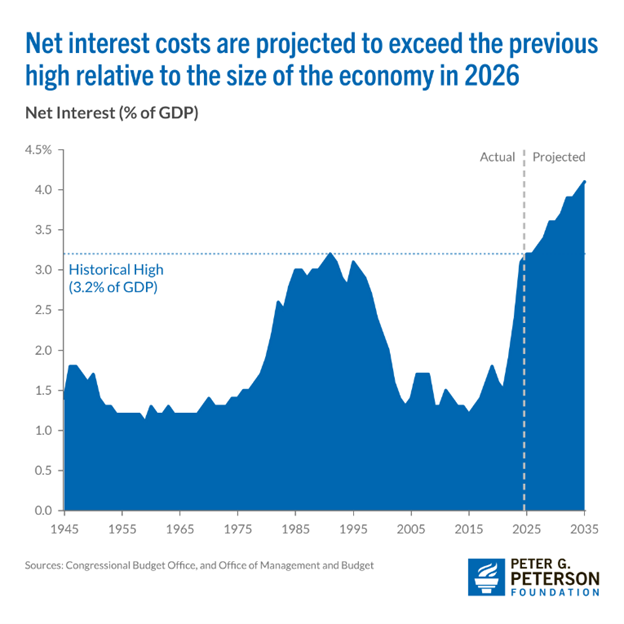

Additionally, the U.S. national debt has surged to $37.43 trillion, with interest payments exceeding Medicare and defense spending, projected to reach $1.8 trillion by 2035. A significant decline in the dollar’s global reserve share and increasing foreign divestment from U.S. Treasuries pose serious risks to the U.S. fiscal policy and dollar dominance.

“`