“`html

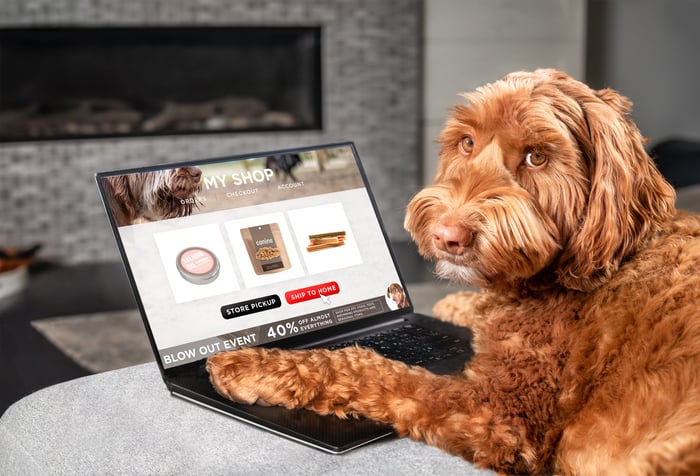

Key Facts About Chewy

Chewy (NYSE: CHWY) reported a revenue increase of 8.6% year-over-year in fiscal Q2, totaling approximately $2.78 billion. The company added 150,000 new customers during the quarter, bringing its total active customer count to around 21 million. Over 80% of its sales come from the Autoship program, which provides a consistent revenue stream that is less vulnerable to economic fluctuations.

Chewy’s business model focuses on non-discretionary products, with 85% of its sales in this category. The gross margin for the company was reported at 30%, but the introduction of higher-margin revenue streams, like health and pharmacy services, aims to enhance profitability moving forward.

Currently, Chewy’s stock has a forward price-to-earnings ratio of around 25, considered attractive compared to other recession-resistant retailers like Costco and Walmart.

“`