“`html

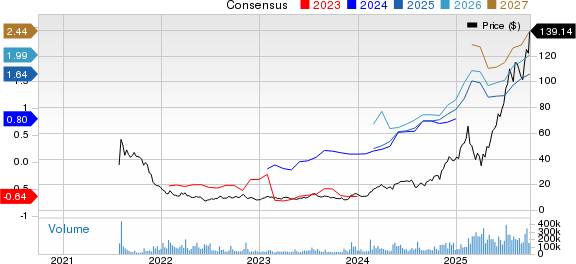

Crude oil prices recently fell to under $60 a barrel, indicating a short-lived surge below peak profitability levels. Chevron (CVX) and Exxon Mobil (XOM) remain key players in the market, jointly controlling over 20% of global oil and gas operations. As of now, Exxon has a market cap of over $477 billion, while Chevron stands at $267 billion.

Despite weaker oil prices leading to sector-wide layoffs and reduced hiring, both companies have maintained strong operational capabilities. Exxon reported a Q2 profit of $1.64 per share, a four-year low, while Chevron’s EPS fell to $1.77 from $2.55 year-over-year. As of this year, Chevron’s stock has increased by 6%, slightly outperforming Exxon’s 4% rise.

Investors may find Chevron’s dividend yield of 4.43% more appealing compared to Exxon’s 3.54%. Both companies have a Zacks Rank of #3 (Hold) due to the challenging market conditions, signaling that there may be better entry points for investment in the future.

“`