“`html

On September 28, 2023, Morgan Stanley reiterated its coverage of Tesla (NASDAQ: TSLA) with an Overweight recommendation. The firm projects an average one-year price target of $244.62, indicating a potential upside of 1.71% from Tesla’s latest closing price of $240.50.

Tesla’s projected annual revenue is $118.5 billion, a 26.04% increase. As of the last quarter, 4,194 funds reported positions in Tesla, an increase of 164 funds (4.07%). The total shares owned by institutions decreased by 3.67% to 1,496,856K shares.

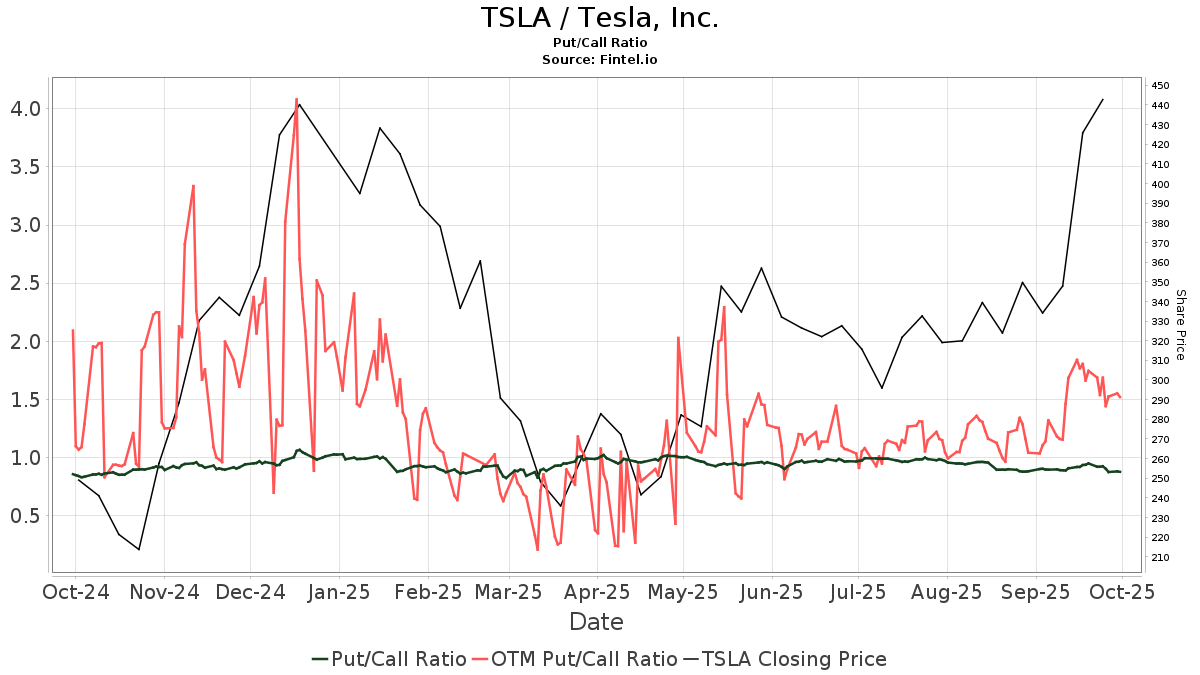

The put/call ratio for Tesla stands at 0.83, indicating a bullish outlook among investors. Major institutional investors like Vanguard and Geode Capital Management have increased their portfolio allocations in TSLA over the last quarter.

“`