“`html

Delta Air Lines (DAL) has emerged as the most profitable U.S. airline following its strong Q3 2023 results, posting sales of $16.67 billion—6% higher than last year’s $15.67 billion and surpassing estimates of $15.79 billion. The company’s net income reached $1.5 billion, or $1.71 per share, exceeding expectations of $1.52.

Key growth drivers included a 9% increase in premium revenue and an 8% rise in corporate sales, indicating a recovery in business travel. Delta’s SkyMiles loyalty program revenue also rose by 9%, highlighting improved customer engagement. Notably, Delta projects Q4 revenue to increase by 2%-4%, with expected EPS between $1.60-$1.90, exceeding expectations of $1.59.

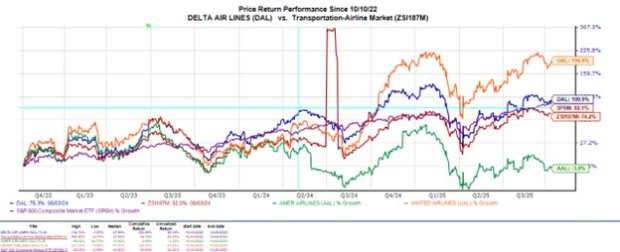

Despite Delta’s stock being down 1% year-to-date, it has gained around 100% over the last three years, compared to United Airlines’ nearly 200%. The airline aims for full-year free cash flow of $3.5-$4 billion and an operating margin of 10.5%-12%.

“`