“`html

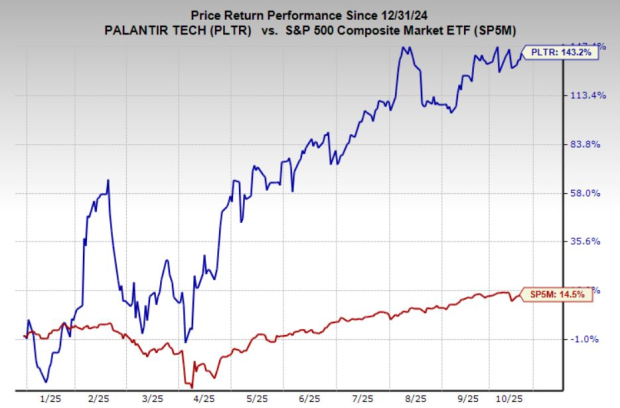

Palantir Technologies (PLTR) shares have risen over 900% in the past two years, currently trading at 213x next year’s earnings. The company projects a 46% sales growth and 61% earnings growth this year. Analysts are watching closely as PLTR approaches a key resistance level at $187, which, if surpassed, could lead to significant momentum buying.

For nearly three months, Palantir’s stock has consolidated in a tight range, setting the stage for a potential breakout. A failure to maintain above the $187 level or a drop below $170 could signal a reversal in sentiment among traders.

Palantir’s valuation remains a topic of debate, yet its combination of recurring government contracts and enterprise adoption positions it among market leaders. The outlook suggests that if a breakout occurs, the stock could mirror the upward trends seen in other top tech names within the AI sector.

“`