“`html

Broadcom’s Rise Amid AI Trends

Broadcom (NASDAQ: AVGO) is experiencing significant growth, currently valued at approximately $1.7 trillion, with projections suggesting it could reach a $2 trillion valuation as soon as next year. The company has seen a sharp increase in its AI revenue, which hit $5.2 billion in Q3 of fiscal 2025, demonstrating a growth rate of 63% from previous quarters. Broadcom’s custom AI accelerator chips, known as XPUs, are gaining traction, despite having a small current customer base.

Key Partnerships and Market Position

Among its clients, Broadcom recently secured a deal to provide 10 gigawatts of computing power to OpenAI, marking a partnership larger than those with competitors like AMD and Nvidia. This increasing demand for specialized AI chips positions Broadcom to potentially capture market share from Nvidia, which currently dominates the AI hardware sector. The strategic growth in AI products could further elevate Broadcom’s market valuation and visibility within tech industries.

Conclusion and Market Outlook

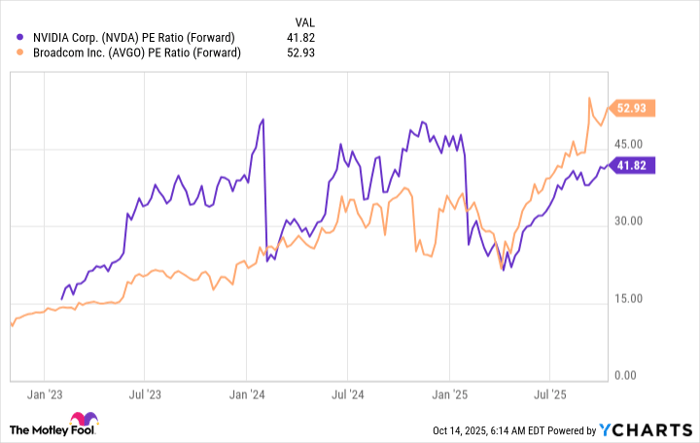

Broadcom is not only recognized for its AI innovations but also boasts a diverse portfolio that includes software and cybersecurity services. However, its stock is currently perceived as overvalued compared to Nvidia, leading to potential challenges in meeting lofty market expectations moving forward.

“`