“`html

Intel Corporation announced third-quarter revenues of $13.7 billion, representing a 3% increase year-over-year, attributed to heightened demand for its Core x86 processors for personal computers. The company’s net income surged to $4.1 billion, or 90 cents a share, reversing a net loss of $16.6 billion in the same quarter last year.

In the Data Center and AI division, revenue reached $4.1 billion, a slight 1% decline year-over-year. Intel looks to bolster this growth through a partnership with NVIDIA Corporation. Additionally, its foundry business generated $4.2 billion in revenue, a 2% decrease from the previous year, but is set to benefit from a collaboration with Microsoft Corporation to develop advanced AI chips.

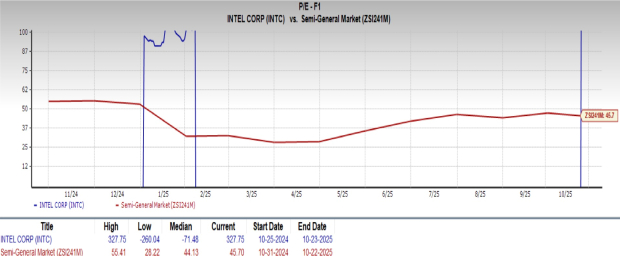

Intel’s stock currently trades at a price-to-earnings (P/E) ratio of 327.75, significantly higher than the semiconductor industry’s average of 45.70. This raises caution for potential investors as the company attempts to navigate its restructuring and partnerships.

“`