“`html

On October 27, 2025, Cantor Fitzgerald reaffirmed its Overweight rating for Tesla (NasdaqGS:TSLA), projecting a 23.33% decrease in price. The average one-year price target is set at $332.54 per share, based on data as of September 30, 2025, with estimates ranging from a low of $19.24 to a high of $630.00. This represents a decline from its recent closing price of $433.72.

The projected annual revenue for Tesla is $187.09 billion, marking a 95.63% increase, with a non-GAAP EPS of $9.02. As of the latest quarter, 5,249 funds are reporting positions in Tesla, reflecting an increase of 164 funds (or 3.23%) from the prior quarter. Institutional ownership of Tesla shares rose by 2.98%, totaling approximately 1.82 billion shares.

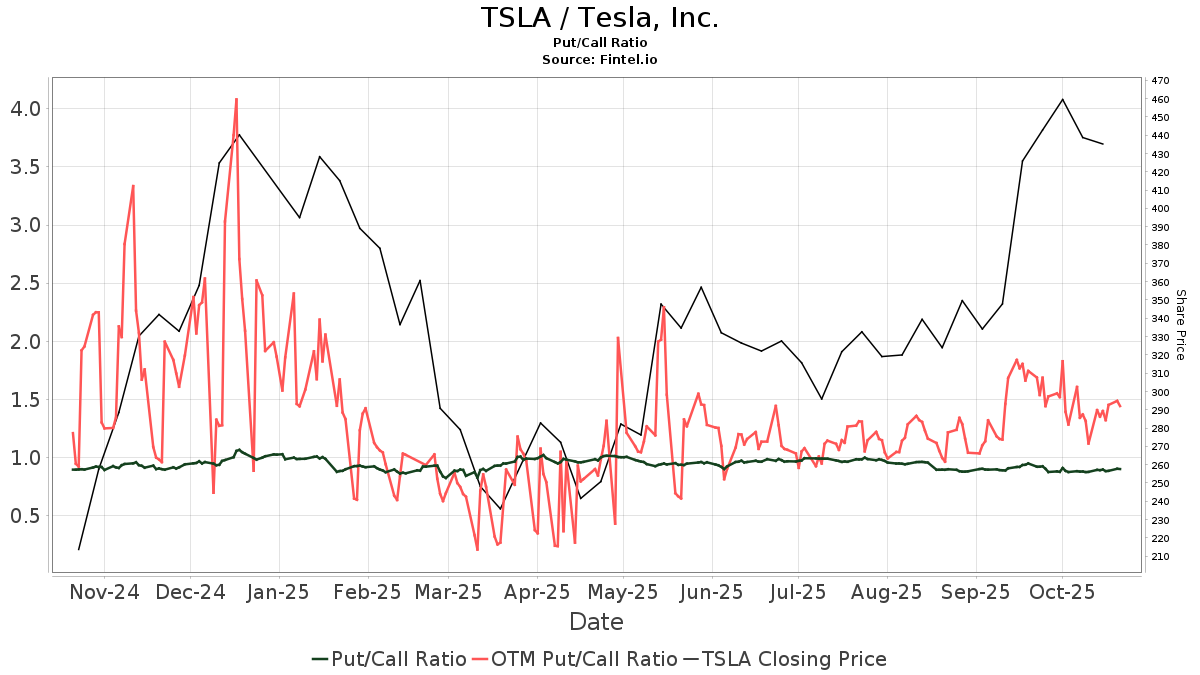

The put/call ratio for TSLA is currently 0.89, indicating a bullish market sentiment.

“`