“`html

On October 30, 2025, Keybanc maintained an Overweight recommendation for Meta Platforms (NasdaqGS:META). The average one-year price target is set at $878.29/share, indicating a potential upside of 31.86% from the latest closing price of $666.08/share, with forecasts ranging from $622.16 to $1,140.30.

Projected annual revenue for Meta is $142.85 billion, reflecting a 24.60% decrease. There are currently 7,018 funds reporting positions in Meta, a rise of 2.54% in the last quarter. Total institutional ownership increased by 1.45% to 1,978,021K shares.

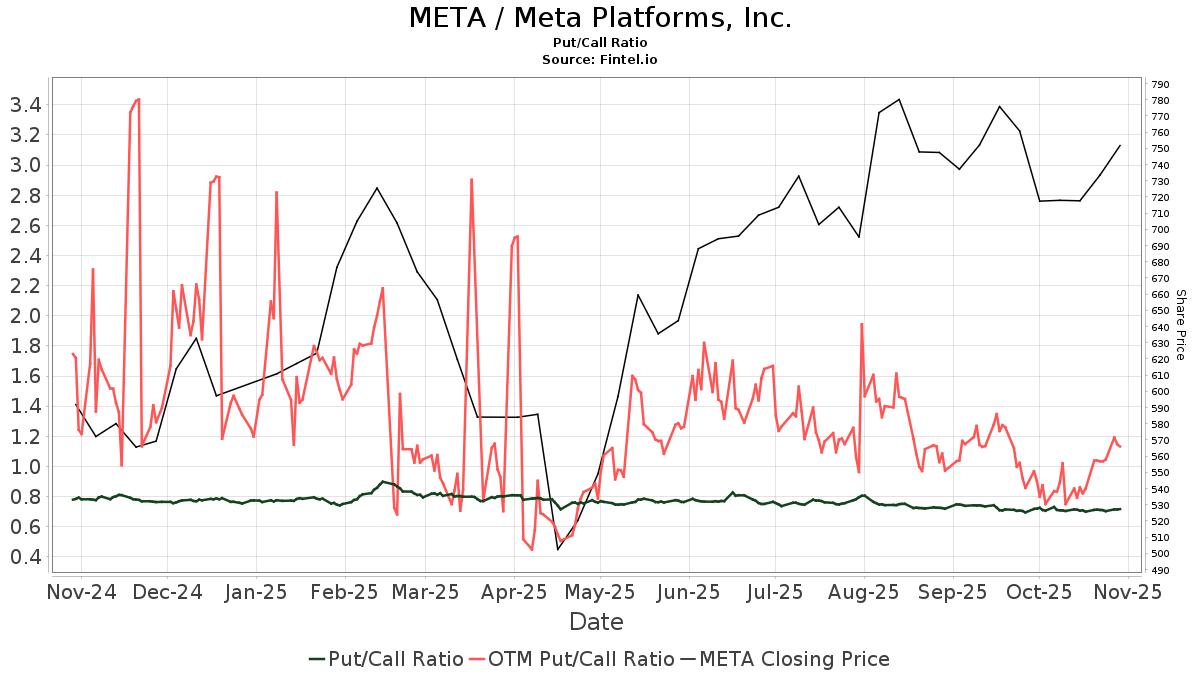

The put/call ratio sits at 0.70, indicating a bullish outlook on Meta’s stock performance.

“`