“`html

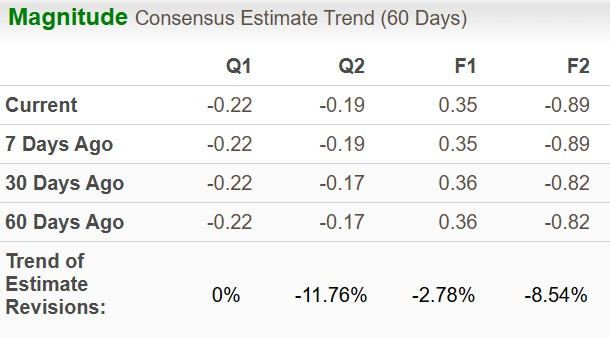

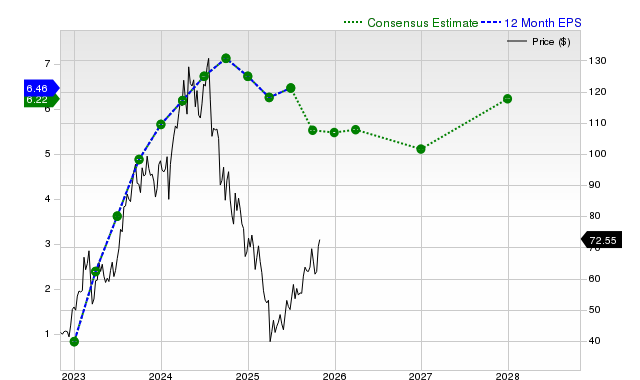

Black Diamond Therapeutics (BDTX) is set to report third-quarter results shortly, with investors keenly awaiting updates on its lead candidate, silevertinib. The Zacks Consensus Estimate indicates a projected loss per share of 22 cents. As of now, the earnings estimate for 2025 has slightly decreased to 35 cents, while the loss per share for 2026 has increased from 82 cents to 89 cents.

BDTX has demonstrated a strong track record, surpassing earnings estimates in the last four quarters by an average of 1,214%. The company is currently engaged in a phase II study of silevertinib, targeting non-small cell lung cancer (NSCLC) and glioblastoma (GBM), with plans to report updates on patient response rates in Q4 2025. As of the end of Q2 2025, BDTX’s cash reserves were approximately $142.8 million, sufficient to fund operations through Q4 2027.

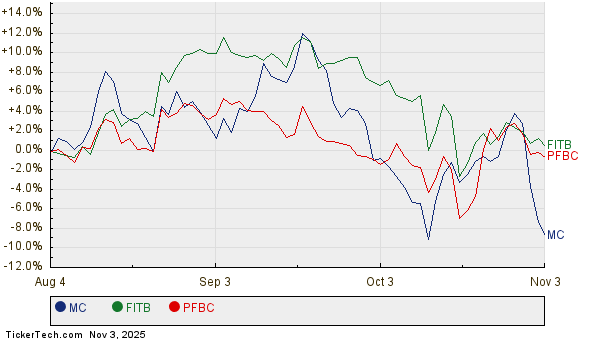

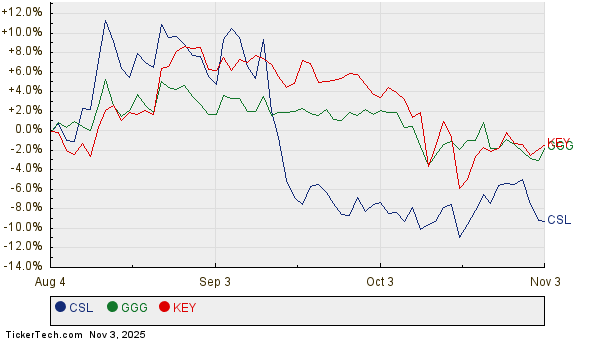

Year to date, BDTX shares have surged 78.5%, outperforming the industry growth of 10.5%. Despite its promising developments, the company faces risks, including reliance on a single pipeline candidate, as it has focused primarily on silevertinib following the outlicensing of its other candidate.

“`