“`html

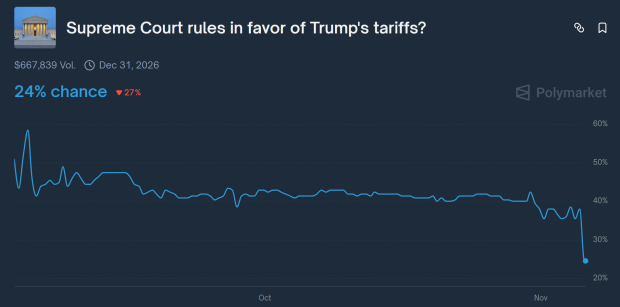

In 2025, the U.S. government is facing its longest shutdown in history while the stock market shows signs of resilience, led by mega-cap stocks, despite underlying weaknesses. Polymarket indicates only a 25% chance that the Supreme Court will uphold President Trump’s “Liberation Tariffs,” currently under review. The S&P 500 Index has recently triggered a Hindenburg Omen, a potential market pullback indicator, with only 17% success in previous instances leading to gains two months later.

The market’s breadth has worsened, recording the highest percentage of stocks at 52-week lows last Thursday, despite approaching record highs. Important criteria for triggering the Hindenburg Omen were met, indicating significant market fragmentation, which may foretell a downturn.

The S&P 500 Index also reached a key Fibonacci extension level, suggesting it may be due for a pause after recent gains. As of now, cautious sentiments are warranted as subtle cracks appear amidst the ongoing bull market.

“`