“`html

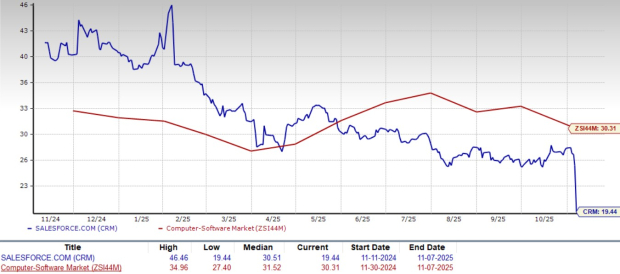

Salesforce, Inc. (CRM) is currently trading at a forward 12-month price-to-earnings (P/E) ratio of 19.44, significantly lower than the Zacks Computer – Software industry’s average of 30.31. In comparison, major competitors like Microsoft, Oracle, and SAP have P/E ratios of 29.97, 32.56, and 31.72, respectively. Despite this attractive valuation, Salesforce has faced a slowdown in sales growth, with revenues increasing by just 8.7% year-over-year in the first half of fiscal 2026.

Salesforce’s earnings per share (EPS) growth is expected to see a compound annual growth rate (CAGR) of 13.9% over the next five years, a significant drop from the previous five years’ CAGR of 27.8%. As of now, Salesforce shares have declined by 28.2% year to date, while its industry has increased by 12.8%.

Furthermore, Gartner projects global spending on generative AI to reach $644 billion in 2025, with enterprise software expected to grow 93.9% to $37.16 billion. Salesforce’s focus on AI, evident in innovations like Einstein GPT and Agentforce, secured $1.2 billion in recurring revenues in the second quarter of fiscal 2026, a 120% increase year-over-year.

“`