“`html

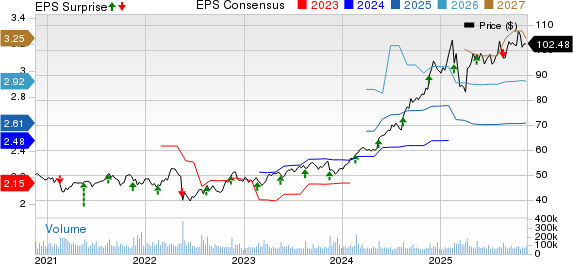

Walmart Inc. (WMT) is set to report its third-quarter fiscal 2026 earnings on November 20, 2023. The Zacks Consensus Estimate projects revenues of $177.1 billion, reflecting a 4.5% increase year-over-year. The consensus for earnings per share is 61 cents, up 5.2% from the previous year. Walmart has a trailing four-quarter average earnings surprise of 2.8%, although it experienced a 6.9% negative surprise in the last quarter.

Walmart’s Q3 results are expected to highlight continued demand and growth, particularly in grocery and consumables. The e-commerce sector, which saw a 25% increase in global sales last quarter, remains a key driver. The company also reported a 46% growth in advertising revenue and a more than 15% increase in membership income from Walmart+ and Sam’s Club as it adapts to consumer needs.

Despite positive expectations, Walmart faces challenges from tariff-driven costs and increased claims expenses. Currently, Walmart holds a Zacks Rank of #3 (Hold) with a positive earnings ESP of +1.15%, indicating potential for an earnings beat in the upcoming report.

“`